Jumbo Loan Limits: How Much Can You Borrow for a High-End Home?

Jumbo Loan Limits: How Much Can You Borrow for a High-End Home?

Blog Article

Navigating the Complexities of Jumbo Lending Options to Discover the Right Suitable For Your Requirements

Navigating the intricacies of big lending choices can be a essential but challenging step for those seeking to fund a high-value property. With a myriad of finance types-- ranging from fixed-rate to interest-only and adjustable-rate-- each alternative offers unique advantages and possible challenges. Recognizing how rate of interest rates and down settlement requirements change in between these options is important.

Recognizing Jumbo Finances

A thorough understanding of big finances is crucial for navigating the complicated landscape of high-value property funding. Unlike standard financings, jumbo lendings are designed for buildings that exceed the Federal Housing Money Firm's adjusting finance limits. These limitations vary by region, reflecting local realty market problems, yet usually go beyond $726,200 in many areas as of 2023. Such lendings are important for acquiring deluxe homes or homes in high-cost locations where standard financing fails - jumbo loan.

Jumbo fundings include distinctive underwriting criteria, commonly needing a lot more rigorous debt criteria. A significant down repayment, normally ranging from 10% to 30%, is additionally a typical requirement, mirroring the loan provider's increased risk direct exposure.

Rate of interest on jumbo finances may differ significantly, in some cases somewhat higher than those for conforming lendings, due to the boosted danger and lack of federal government backing. Understanding these nuances is crucial for consumers intending to secure financing tailored to high-value real estate deals.

Comparing Lending Kinds

Jumbo lendings, usually required for financing homes that surpass traditional funding limitations, come in different types, each with unique functions tailored to particular consumer accounts. Fixed-rate jumbo finances are usually favored for their predictability, providing a regular rate of interest rate and monthly settlement throughout the lending period, which can relieve budgeting issues.

On the other hand, adjustable-rate jumbo financings (ARMs) offer preliminary periods of lower rate of interest, typically making them an attractive selection for debtors that anticipate selling or refinancing before the rate readjusts. The primary allure here is the potential for significant savings during the first set duration, although they bring the risk of rate boosts gradually.

Interest-only big finances existing one more choice, allowing borrowers to pay just the interest for a specified duration. This alternative can be beneficial for those seeking lower preliminary settlements or who anticipate a considerable income rise in the future. Each finance kind has possible drawbacks and distinct benefits, making cautious consideration essential to lining up with lasting economic techniques.

Assessing Rate Of Interest Rates

Rates of interest play a crucial function in determining the general price of a jumbo loan, making their examination a vital element of the home loan selection procedure. In the context of big car loans, which are not backed by government-sponsored entities and usually include greater amounts, rate of interest can differ a lot more considerably than with adjusting fundings. This variation necessitates a comprehensive understanding of how rates are identified and their long-lasting economic effect.

The rates of interest on a big lending is influenced by several factors, consisting of the loan provider's plans, market problems, and the debtor's creditworthiness. Lenders generally evaluate the customer's credit report rating, debt-to-income ratio, and economic gets to set the price. It's important for consumers to compare rates from different lenders to guarantee they secure one of the most beneficial terms.

Taken care of and adjustable-rate home mortgages (ARMs) use different passion rate frameworks that can influence repayment stability and total loan expenses - jumbo loan. A fixed-rate financing offers consistency with predictable month-to-month payments, whereas an ARM may provide a reduced preliminary price with potential modifications over time. Reviewing these choices in the context of existing rate of interest fads and personal monetary objectives is crucial for maximizing the cost-effectiveness of a jumbo car loan

Assessing Deposit Requirements

Unlike traditional financings, big car loans commonly need a greater down payment due to their dimension and threat account. Lenders typically set the minimum down payment for big finances at 20%, yet this can vary based on factors such as credit report rating, car loan quantity, and the residential property's place.

The down repayment not just impacts the size of the financing but likewise influences the interest price and exclusive home loan insurance (PMI) responsibilities. A bigger deposit can cause much more desirable financing terms and potentially eliminate the requirement for PMI, which is often my latest blog post needed when the deposit is less than 20%. For that reason, consumers ought to consider their economic ability when identifying the proper down payment.

Furthermore, some lending institutions may use adaptability in deposit choices if borrowers can demonstrate strong monetary health, such as considerable money gets or a superb credit report. Potential jumbo car loan consumers need to thoroughly examine these variables to maximize their mortgage method.

Selecting the Right Lender

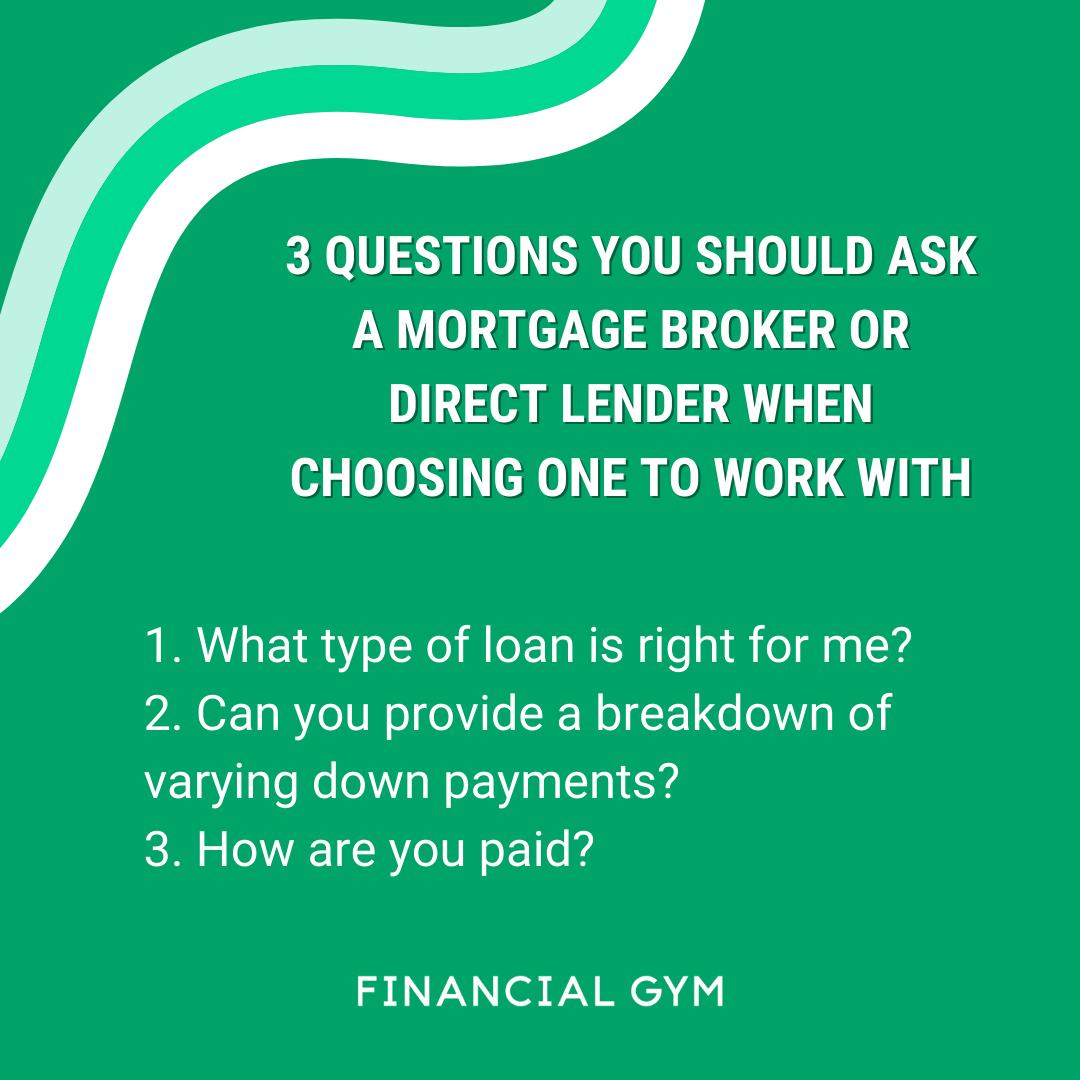

Picking the right loan provider for a big financing is a pivotal decision that can substantially influence the terms and success of your home mortgage. Big financings, often exceeding the conforming funding limitations, present special challenges and possibilities that demand careful factor to consider when picking a financing partner. A great post to read loan provider's experience with jumbo fundings, flexibility in underwriting, and affordable rates of interest are crucial variables that must be completely assessed.

Developed lending institutions with a history of effective jumbo lending processing can use valuable understandings and smoother purchases. Considering that jumbo lendings are not standardized like conventional financings, a lending institution that provides tailored solutions and products can much better align with your economic goals.

Moreover, openness in fees and interaction is necessary. Make sure that potential lending institutions clearly describe all linked expenses, terms, and conditions. Engaging with loan providers that focus on clear communication can stop misconceptions and unanticipated monetary concerns. Ultimately, compare multiple loan providers to gauge affordable rates of interest and terms. A detailed contrast will certainly encourage you to make an educated decision, ensuring that the picked loan provider supports your monetary objectives properly.

Verdict

Navigating the intricacies of jumbo funding alternatives requires a comprehensive analysis of finance kinds, rates of interest, and down settlement demands. An extensive evaluation of economic situations, including credit rating scores and debt-to-income proportions, is crucial in determining the most suitable lending kind. Furthermore, picking loan providers with expertise in big lendings can enhance the probability of securing positive terms. Lining up car loan features with lasting monetary goals guarantees informed decision-making, inevitably assisting in the choice of a car loan that finest satisfies private demands and scenarios.

Unlike traditional fundings, big financings are designed for residential or redirected here commercial properties that surpass the Federal Housing Finance Firm's adhering lending limits. Fixed-rate big car loans are often favored for their predictability, supplying a consistent interest rate and monthly repayment throughout the lending period, which can ease budgeting problems. In the context of jumbo financings, which are not backed by government-sponsored entities and commonly involve greater amounts, rate of interest prices can differ much more dramatically than with adhering financings. Since big loans are not standardized like traditional finances, a loan provider that offers customized services and items can better line up with your financial goals.

Report this page